History:

1. Founded in 2013 in China.

2. Initially focused on the Chinese market.

3. Expanded globally in 2017.

4. Entered the US market in 2018 but withdrew due to regulatory issues.

5. Re-entered the US market in 2022 as an asset manager.

Huobi US has had a bit of a complicated history. The Chinese crypto exchange initially entered the US market in 2018 but quickly withdrew due to regulatory hurdles ¹. However, in 2022, Huobi announced plans to re-enter the US market, but this time as an asset manager, rather than a full-fledged crypto exchange ¹.

Currently, Huobi operates globally, offering its services in various countries, including the US, but with certain limitations. For instance, USD deposits and withdrawals are not supported, and Huobi doesn’t offer USD trading accounts ².

Key Features of Huobi:

– Over 600 Cryptocurrencies Supported: Huobi offers a wide range of assets for trading, including popular ones like Bitcoin, Ethereum, and Solana ².

– Multiple Fiat Currencies: Huobi supports trading with 11 currencies, including USD, GBP, AUD, EUR, and more ².

– Various Payment Methods: Huobi accepts several payment methods, including AdvCash and Wire transfer ².

Challenges and Limitations:

– Regulatory Hurdles: Huobi’s previous experience in the US market highlights the regulatory challenges it faces ¹.

– Limited Customer Support: Huobi doesn’t offer live chat or phone-based customer support, which might be inconvenient for some users ².

– No Mobile App: Huobi doesn’t have a dedicated mobile app, which might affect the user experience ².

Services:

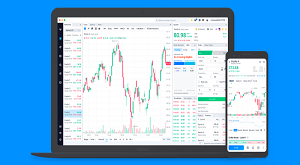

1. Crypto trading: Spot, margin, and futures trading.

2. Asset management: Investment products, ETFs, and pension plans.

3. Wallet services: Secure storage for cryptocurrencies.

4. Mining pool: Huobi Pool for cryptocurrency mining.

5. Research and development: Huobi Research Institute.

Huobi US (HBUS):

1. Launched in 2018 as a US-based subsidiary.

2. Offered crypto trading and OTC services.

3. Closed in 2019 due to regulatory hurdles.

Regulatory Status:

1. Registered with FinCEN in the US.

2. Compliant with AML/KYC regulations.

3. Licensed in Singapore, Japan, and South Korea.

Security Measures:

1. Multi-signature wallets.

2. Two-factor authentication.

3. Cold storage.

4. Regular security audits.

Fees:

1. Trading fees: 0.02%-0.2%.

2. Withdrawal fees: Vary by cryptocurrency.

3. Deposit fees: None.

Supported Cryptocurrencies:

1. Over 600 cryptocurrencies.

2. Popular assets: Bitcoin, Ethereum, Solana.

3. Huobi Token (HT): Native cryptocurrency.

Customer Support:

1. Email support.

2. Ticket system.

3. Limited live chat support.

Mobile App:

1. No dedicated mobile app.

2. Mobile web version available.