Long-term health and financial security are critical considerations for individuals and families, and they are closely linked to various aspects of healthcare coverage and planning. Here are some detailed aspects of how long-term health and financial security are interconnected:

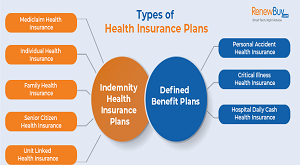

1. Health Insurance Coverage: Access to comprehensive health insurance coverage is a cornerstone of long-term health and financial security. Health insurance provides individuals and families with the means to afford essential healthcare services, including preventive care, treatment for acute and chronic conditions, and access to prescription medications. By having health insurance, individuals can mitigate the financial risks associated with unexpected medical expenses and ensure that they receive necessary care to maintain their health over the long term.

2. Preventive Care and Early Intervention: Health insurance plans that cover preventive services, such as screenings, vaccinations, and wellness visits, play a crucial role in promoting long-term health and financial security. By facilitating early detection and intervention for health issues, preventive care can help individuals avoid more serious and costly health problems in the future. This proactive approach to healthcare not only supports long-term well-being but also reduces the financial burden associated with treating advanced or preventable illnesses.

3. Chronic Disease Management: Long-term health and financial security are particularly impacted by the management of chronic health conditions. Comprehensive health insurance coverage that includes access to specialists, medications, and ongoing care for chronic diseases such as diabetes, heart disease, and asthma is essential for maintaining health and preventing costly complications. Effective management of chronic conditions can lead to improved health outcomes, reduced healthcare expenses, and enhanced overall financial security for individuals and families.

4. Access to Mental Health Services: Mental health is a critical component of long-term well-being, and access to mental health services through health insurance is vital for overall health and financial security. Coverage for mental health counseling, therapy, and psychiatric care can support individuals in managing stress, anxiety, depression, and other mental health challenges, ultimately contributing to their long-term health and stability.

5. Retirement Planning and Healthcare Costs: Long-term financial security often involves planning for healthcare expenses in retirement. Health insurance options, such as Medicare and supplemental coverage, play a significant role in providing healthcare benefits for retirees. Understanding and preparing for potential healthcare costs in retirement is essential for maintaining financial stability and ensuring access to necessary medical care as individuals age.

6. Long-Term Care and Disability Coverage: Long-term health and financial security also encompass planning for potential long-term care needs and disability. Health insurance options that include coverage for long-term care services, as well as disability insurance, can help individuals and families prepare for the financial impact of serious illness, injury, or disability. This type of coverage can provide peace of mind and financial protection in the event of extended healthcare needs.

7. Health Savings and Investment Strategies: Individuals can enhance their long-term financial security by utilizing health savings accounts (HSAs), flexible spending accounts (FSAs), and other investment strategies that allow for tax-advantaged savings to cover healthcare expenses. These financial tools can help individuals build resources to address healthcare costs over time, contributing to their overall financial stability and security.

In summary, long-term health and financial security are interconnected, and comprehensive health insurance coverage, access to preventive and chronic care, and strategic financial planning for healthcare expenses all play crucial roles in supporting individuals and families in achieving and maintaining both their health and financial well-being over the long term.