Health insurance is a critical component of ensuring access to quality healthcare and protecting individuals and families from the financial burden of medical expenses. With the rising costs of healthcare, having adequate health insurance coverage is essential for individuals to receive timely and necessary medical care without facing substantial financial strain. In this article, we will explore the importance of health insurance, the different types of health insurance plans available, and the benefits of having comprehensive health insurance coverage.

Importance of Health Insurance

Health insurance plays a vital role in safeguarding the well-being of individuals and families, providing financial protection against the high costs of medical treatment. Without health insurance, individuals may be forced to bear the full burden of medical expenses, which can lead to significant financial hardship. In the absence of insurance coverage, people may delay seeking necessary medical care, leading to the exacerbation of health conditions and potentially avoidable complications.

Moreover, health insurance not only covers the costs of medical treatment but also provides access to preventive care, such as wellness exams, vaccinations, and screenings. By promoting preventive care, health insurance can help individuals maintain good health and detect potential health issues early, leading to better health outcomes and reduced healthcare costs in the long run.

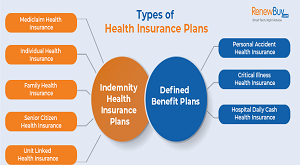

Types of Health Insurance Plans

There are several types of health insurance plans available, each with its own features, benefits, and costs. Understanding the differences between these plans is crucial for individuals and families to select the most suitable coverage based on their healthcare needs and budget. Some common types of health insurance plans include:

1. Health Maintenance Organization (HMO): HMO plans typically require individuals to select a primary care physician (PCP) and obtain referrals from the PCP to see specialists. These plans often have lower out-of-pocket costs but may have more limited provider networks.

2. Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers and do not require referrals to see specialists. While PPO plans may have higher premiums and out-of-pocket costs, they provide greater freedom in accessing medical services.

3. High-Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles, meaning individuals are responsible for a significant portion of their healthcare costs before the insurance coverage kicks in. HDHPs are often paired with Health Savings Accounts (HSAs) to help individuals save for medical expenses.

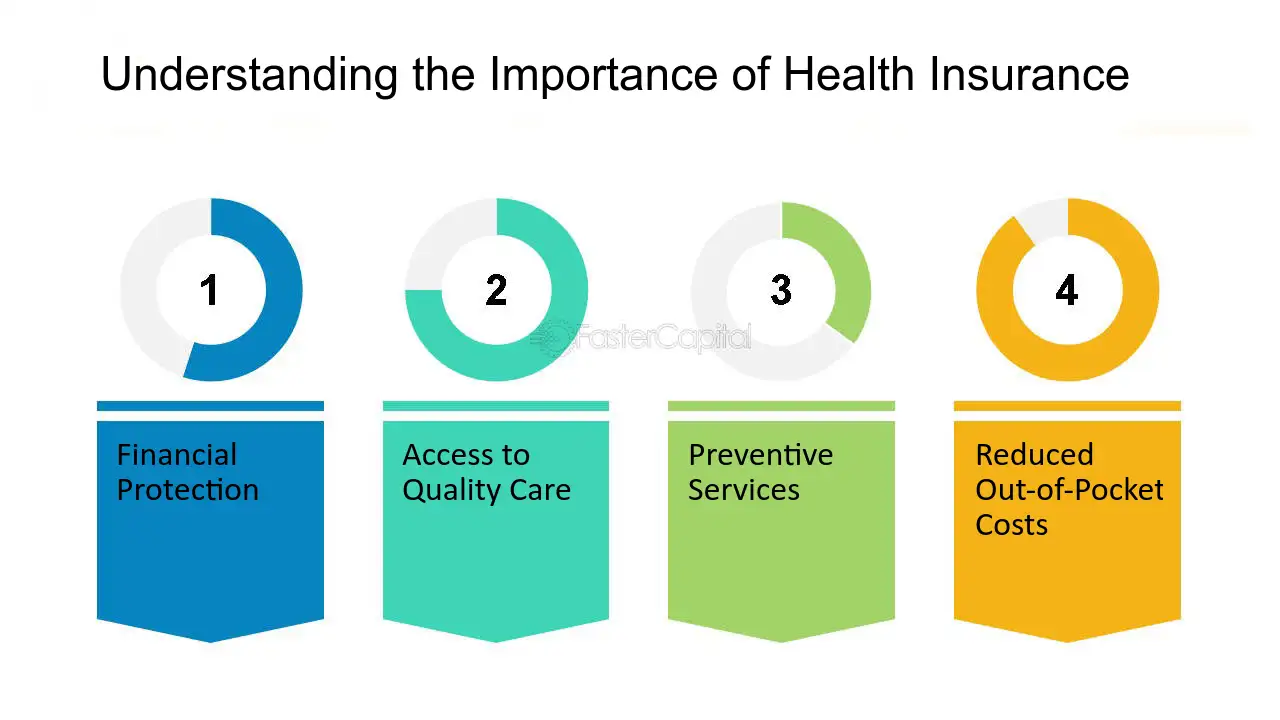

Benefits of Health Insurance Coverage

Comprehensive health insurance coverage offers numerous benefits to individuals and families, including:

1. Financial Protection: Health insurance shields individuals from the potentially overwhelming costs of medical treatment, ensuring that they can access necessary healthcare services without facing financial hardship.

2. Access to Quality Care: With health insurance, individuals can seek medical care from a wide network of healthcare providers, including primary care physicians, specialists, hospitals, and clinics, thus ensuring access to quality healthcare services.

3. Preventive Care: Health insurance plans often cover preventive services such as vaccinations, screenings, and wellness exams, promoting early detection of health issues and proactive management of chronic conditions.

4. Prescription Drug Coverage: Many health insurance plans include coverage for prescription medications, reducing the out-of-pocket expenses for necessary medications.

5. Mental Health Services: Comprehensive health insurance often includes coverage for mental health services, ensuring access to counseling, therapy, and treatment for mental health conditions.

6. Maternity and Pediatric Care: Health insurance plans typically provide coverage for maternity care, childbirth, and pediatric services, supporting the health needs of expectant mothers and children.

7. Long-Term Health and Financial Security: By having health insurance, individuals can protect their long-term health and financial well-being, reducing the risk of facing substantial medical bills that could lead to debt or bankruptcy.

In conclusion, health insurance is a fundamental aspect of ensuring access to quality healthcare and protecting individuals and families from the financial burden of medical expenses. By providing financial protection, access to preventive care, and coverage for a wide range of healthcare services, health insurance plays a crucial role in promoting the well-being and long-term security of individuals. Therefore, understanding the importance of health insurance and selecting the most suitable coverage is essential for individuals to safeguard their health and financial well-being.