Subsequent to undertaking a complete survey of its hierarchical construction and supervisory groups, global guarantor MAPFRE has declared that it is introducing changes to more readily adjust to the developing and unpredictable business scene in the midst of a blend of financial, social, and geostrategic vulnerabilities.

Notwithstanding a plan of action that has demonstrated powerful quarter by quarter, the organization said that it tries to save its administrative roles across different business sectors. To explore what is going on, described by more prominent flimsiness and eccentricism, the organization is moving towards less complex and more adaptable designs that focus on its center tasks, upgrading client relations and keeping up with administration greatness.

The redesign of the supervisory crew includes an essential mix of involvement and arising ability, meaning to saddle the full range of the board capacities and quickly jump all over various chances not too far off.

Exec moves for MAPFRE

The corporate arrangements incorporate José Manuel Inchausti succeeding Ignacio Baeza as the main bad habit administrator, and Fernando Mata assuming the job of third bad habit director while going on as the gathering’s CFO. Moreover, Raúl Costilla has been named as the gathering’s central business official, answerable for coordinating the gathering’s deals and specialized procedure internationally.

With an end goal to improve on the corporate design, Individuals, Procedure, and Supportability have been coordinated into a solitary region drove by Alfredo Castelo. The Corporate Inner Review Region will see José Luis Gurtubay taking over from Walk 31, 2024.

Key arrangements in Iberia incorporate Elena Sanz Isla as President of MAPFRE Iberia and Jesús Martínez Castellanos as appointee Chief and Chief of MAPFRE Vida.

The specialty units go through changes too, with geological regions like LATAM and EMEA incorporated into another unit called Worldwide Protection, drove by Eduardo Pérez de Lema. Miguel Ángel Rosa has been named President of MAPFRE RE, while Mónica García Cristóbal becomes Chief of Verti Germany.

The redesign stretches out to a few gathering nations, with new Presidents designated in Mexico, Brazil, the Dominican Republic, Chile, and Panama and Focal America.

Alberto Berges, MAPFRE Mexico President

Óscar Celada, MAPFRE Seguros business President

Nelson Alves, MAPFRE Seguros agent Chief of money and business support

Andrés Mejía, MAPFRE Dominican Republic President

Eva Tamayo, MAPFRE Chile President

Óscar Ortega, MAPFRE Panama and Focal America President

These progressions will produce results on Jan. 1, 2024, aside from the interior review arrangement.

“We are establishing the groundworks of the organization for the following 10 years,” said Antonio Huertas, administrator and President of MAPFRE. “All that we have accomplished up to this point, particularly monetary strength, administration greatness and closeness to the client, the attention on individuals and the support of our moral responsibility and values, will be kept up with as fundamental and separating components of MAPFRE. In any case, the climate has changed, and we will push ahead with a new, easier guide that gives us the adaptability and capacity we really want to keep standing firm on authority footholds in the gathering’s primary business sectors.”

MAPFRE Q3 2023 results

Other than the significant administration purge, the organization additionally uncovered its financials for the second from last quarter of the year. MAPFRE promoted vigorous monetary execution for the initial nine months of 2023 – a pattern going on from its last monetary report – exhibiting critical development in both income and results.

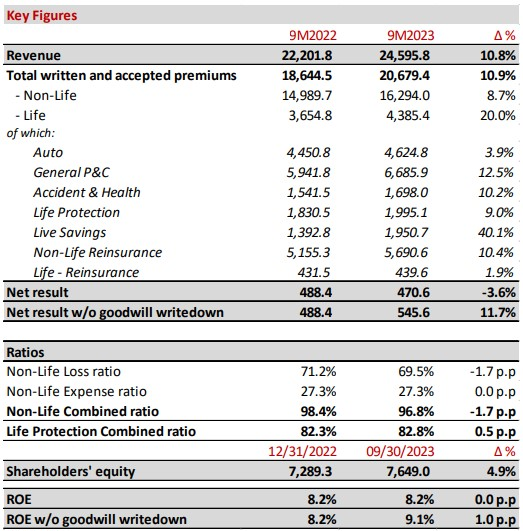

The 10.8% flood in income highlights the continuation of positive patterns saw in late quarters, driven by a significant expansion in business volume and upgraded monetary execution. Prominently, expenses enlisted a 10.9% rise, with negligible effect from conversion scale vacillations (at steady rates, charges expanded by 12%).

This development reflects a wide improvement in business, with non-life expenses expanding by 8.7% and life charges taking off by 20%. Key contributing variables to this development incorporate the areas of IBERIA and LATAM, as well as the positive execution of the Reinsurance business.

Inside the non-Life fragment, charges encountered an ascent of over €1.3 billion during the initial nine months of the year. This development was especially articulated in everyday property and setback (P&C) with a development pace of 12.5%, while mishap and wellbeing charges expanded by 10.2%, and collision protection saw a 3.9% ascent.

Notwithstanding the monetary situation’s unpredictability and scattering saw in past quarters, the consolidated proportion for non-life improved to 96.8%, denoting a decrease of 1.7 rate focuses. General P&C displayed an exemplary joined proportion of 87.1%, which was 2.8% better than the past time frame. This made up for continuous difficulties in the collision protection portion, which had a joined proportion of 105.9%, a slight improvement of 0.3% contrasted with June.

In the existence business, expenses flooded by more than €730 million, mostly determined by life reserve funds in Spain. The positive exhibition in this line can be credited areas of strength for to capability and strong monetary pay, especially in Latin America. The existence security joined proportion stayed superb at 82.8%. Thusly, the existence specialized monetary outcome saw a 7% improvement.

Critical occasions influencing monetary outcomes remembered the tremor for Turkey in the principal quarter, with a €105 million effect on the net outcome. This occasion essentially impacted MAPFRE RE (€100 million) and minorly affected the nearby back up plan (€5 million). In 2022, the most significant disastrous occasion was the dry season in Brazil, which had a net effect of €106 million on the Gathering. In 2023, an ideal reinsurance market climate and a milder tropical storm season added to MAPFRE RE accomplishing a consequence of €190 million, multiplying the earlier year’s presentation.

The second from last quarter likewise witnessed two essential financial occasions: a positive net effect of €46.5 million coming about because of mediation in regards to the finish of the partnership with Bankia and a judicious €75 million temporary effect for a generosity record for the organization’s protection tasks in the US. This get on paper, representing 11% of its book esteem, was made in light of increasing financing costs and testing conditions in the collision protection area because of expansion. The gauge for this altruism record will be refreshed at year-end in light of loan fees and field-tested strategies.

As to speculation portfolio, there were no huge changes in the resource class structure during the second from last quarter. Acknowledged gains net of disabilities millionly affected the net outcome for the period, contrasted with €70.8 million in a similar period in 2022.

“Our business keeps on showing vigor, both in income and premium development as well as in the outcome, in light of an elevated degree of broadening and capacity to adjust to the unique circumstance. MAPFRE is defeating the troubles introduced by expansion, on account of persistent improvement in view of our specialized administration,” Huertas said.

MAPFRE unveils half-year results

Worldwide insurance agency MAPFRE experienced significant development in the main portion of 2023, with income flooding by 15% and coming to an amazing €17 billion (about $18.73 billion), as per results delivered by the organization.

In any case, the net outcome was marginally influenced, remaining at €317 million, a 6% decline. The plunge was ascribed to difficulties in the auto section and the repercussions of the quake in Turkey.

Among the locales, Iberia exhibited surprising execution, flaunting the most noteworthy development rate at more than 20%. In the mean time, in Latin America, net outcomes took off to €193 million, essentially adding to the general profit of the organization.

Eminently, the non-life area showed upgrades, with a lower consolidated proportion of – 1.3 rate focuses, basically determined by broad property and setback. Furthermore, the monetary outcome made a huge commitment, flooding by 26%.

In the existence fragment, charges saw a striking increment of 29%, joined by a 16% improvement in the Existence specialized monetary outcome.

MAPFRE RE, the reinsurance arm of the organization, contributed €121 million to the general outcomes and exhibited vigorous business development.

Peruse straightaway: MAPFRE uncovers entire year results

Interestingly, MAPFRE S.A. introduced its records under the new bookkeeping guidelines, IFRS 17 and 9.

The organization likewise declared that it had gotten a good mediation administering for its situation concerning the end of the partnership with Bankia.

“The strength that our incredible broadening gives us is repaying every one of the troubles that the Auto line keeps on looking from expansion,” said Antonio Huertas (presented above), administrator of MAPFRE. “In Iberia, expenses are becoming more than 20%, while business in LatAm is likewise serious areas of strength for showing, where hostile to expansion measures were taken on before and are beginning to be found in the outcome. MAPFRE RE has contributed essentially to the outcome.”

MAPFRE reveals full-year results

Protection monster MAPFRE has reported its entire year results for 2022.

MAPFRE’s inferable profit in 2022 added up to €642 million (about $689.9 million), 16.1% down from the earlier year. On a practically identical premise with 2021, when changed income were €703 million, 2022 profit would have been 7% lower.

The organization said its enhanced business assisted with accomplishing a maintainable outcome, counterbalancing the greater part of the year’s adverse consequences: high expansion in many business sectors, an expansion in claims levels in the auto business, and horrendous cases – particularly those subsequent from the dry season in South America’s Paraná waterway bowl, which surpassed €12 million.

On the positive side, MAPFRE noted brilliant execution in Latin America, “marvelous development” of MAPFRE RE’s outcomes, and high development in both property-loss and life coverage.

“Benefit, with a ROE of 8.2%, was like that accomplished on a like-for-like premise in 2021,” MAPFRE said.

Bunch income rose 8.3% in 2022 to €29.51 billion, while expenses became by 10.8% to outperform €24.54 billion.

“This expansion in expenses mirrors an overall improvement in the protection business across essentially all locales, with huge expansions in Latin America and North America, as well as in the reinsurance and enormous dangers organizations, with practically all monetary forms performing well against the euro,” MAPFRE said.

The organization’s consolidated proportion rose 0.6 rate focuses to 98%, driven by the ascent in auto claims – a result of high expansion and the expansion in versatility following the finish of Coronavirus limitations.

MAPFRE’s inferable value toward the finish of 2021 was €7.20 billion, while all out resources were €59.3 billion.

The organization’s speculations all out €41.39 billion, a big part of which relate to sovereign fixed pay.

Annuity store value added up to €5.7 billion toward the finish of 2022, while common assets became by 2.3% to €5.53 billion.

Toward the finish of September 2022, the organization’s Dissolvability II proportion remained at 216.8% with 84% top notch capital (Level 1).

“This proportion mirrors a judicious way to deal with the monetary record and dynamic venture the board, as well as major areas of strength for the versatile monetary record of MAPFRE,” the organization said.